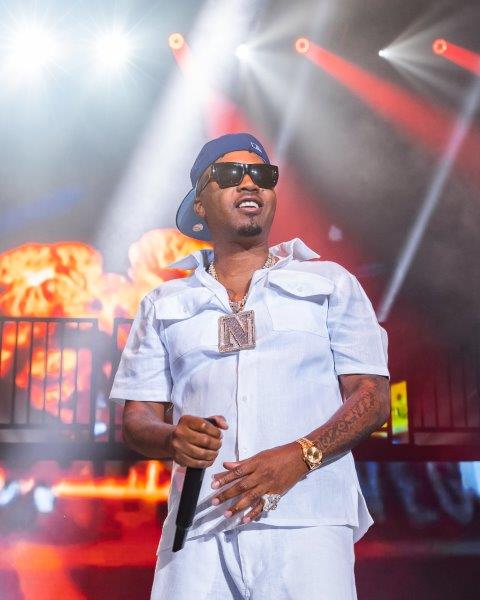

Nas is known for arguably being one of the greater rappers of our time. However, in the past few years, Nas has added a different title to his name, that of a tech investor. Nas has invested in over 40 companies as a founding partner of Queensbridge Venture Partners. Queensbridge Venture Partners is a venture capital firm created by the rapper and his manager, Anthony Saleh. Nas said he decided to get involved in tech investments because he wanted “to be surrounded by the smartest people in the world.”

Nas has quite an impressive investment profile. Here are some of the companies he has invested in, along with their valuations: Dropbox- $10 billion valuation, Lyft- $5.5 billion valuation, Tilt- $400 million valuation, and Robinhood-raised $50 million in Series B. He was also an early investor in Ring, the smart doorbell company. After Amazon acquired Ring, he made $40 million, following Ring’s $415 million in sales in 2018. Nas was also an early investor in Coinbase, an online platform for buying, selling, transferring, and storing cryptocurrency. His stake is now worth $40 million.

Earlier this year, Nas teamed up with Google to raise $20 million in financial banking for Carry1st, a South African gaming company. SpongeBob, Mine Rescue, and Match League are just a few of the games released by Carry1st. In an interview with THR, Carry1st co-founder and CEO Cordel Robbin-Coker said, “We’re excited to partner with this world-class group of investors who, in addition to capital, bring expertise across gaming, fintech, and web3. In 2021, we launched multiple games and digital commerce solutions, achieving really strong growth. Together we can accelerate this growth and achieve our goal of becoming the leading consumer internet company in the region.”

At this rate, it does not look like the Queensbridge rapper is slowing down any time soon, and we are here for it.

![‘Belle Collective’ Returns February 13 With A Blindsiding Betrayal, Infidelity Allegations & Lateshia Vs. Latrice [Trailer Exclusive]](https://bossip.com/wp-content/uploads/sites/28/2026/01/17684194473124.jpg?w=1024&strip=all&quality=80)

![Actress Zing Ashford Says Starring In ‘Mary J. Blige Presents: Be Happy’ Changed How She Shows Up For Her Mom [Exclusive]](https://bossip.com/wp-content/uploads/sites/28/2026/02/17703050131227.png?w=1024&strip=all&quality=80)